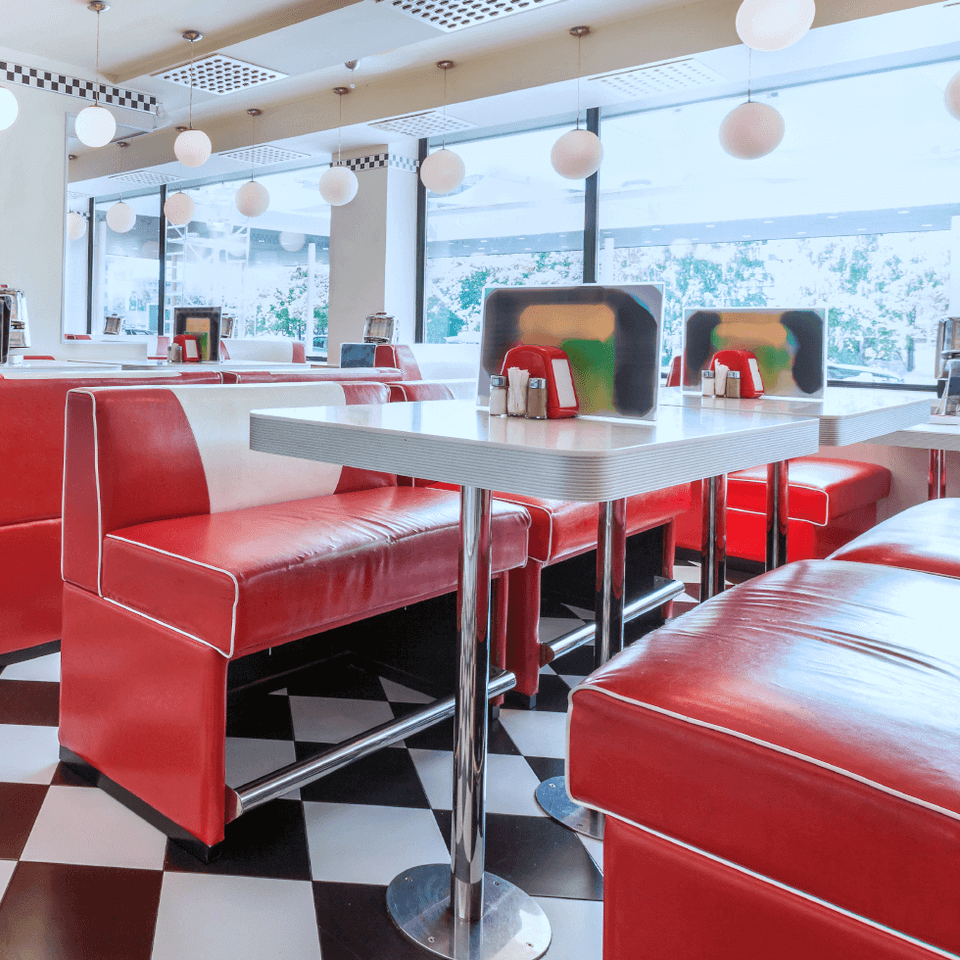

Protect against

property damage and loss

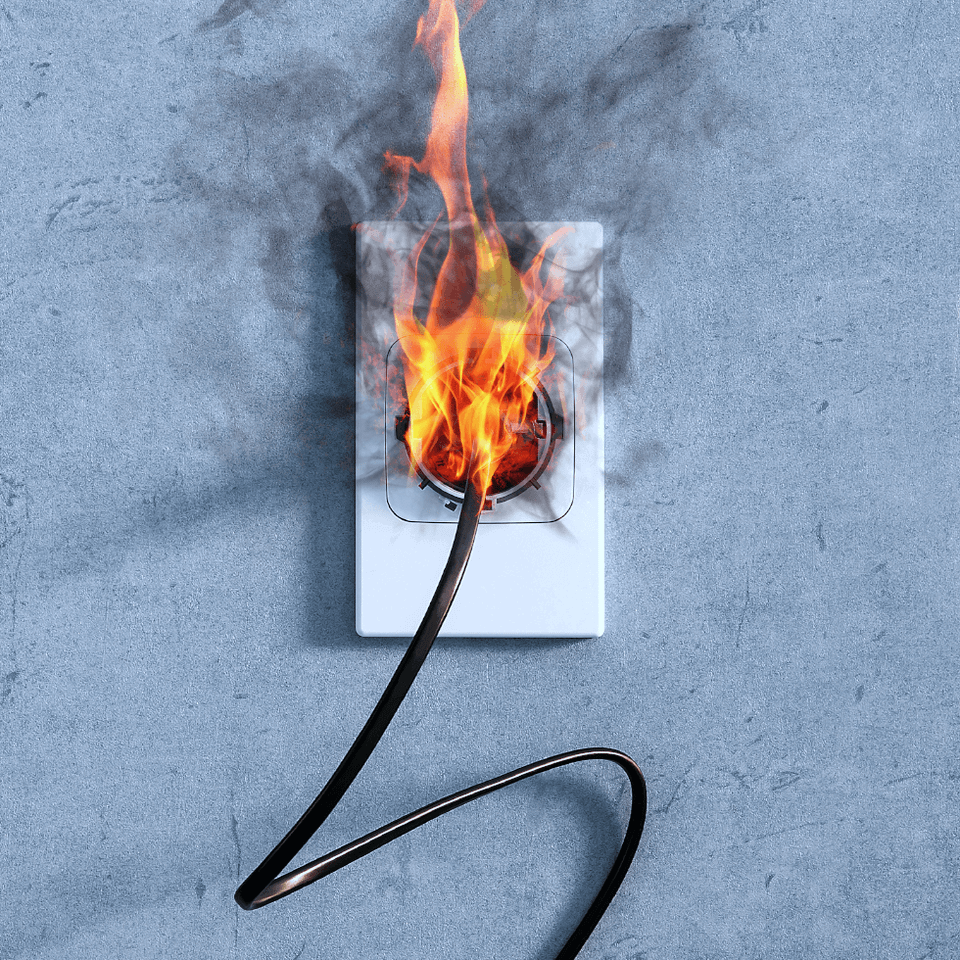

It's a nightmare for anyone in the restaurant business; but imagine a grease fire quickly igniting and consuming your kitchen. According to the National Fire Protection Association, there's an average of more than 7,000 restaurant fires each year (NFPA). FEMA reports that restaurant fires can average $23,000 in losses (FEMA). A responsible business owner hopes for the best but always prepares for the worst.

Some basic coverages you'll need to protect your property include:

Some basic coverages you'll need to protect your property include:

- Commercial property insurance: for your building in case of fire, accident, or vandalism

- Business owners policy: a cost-effective bundle for your property and general liability insurance

- Commercial auto insurance: for delivery drivers and supply runs