Maintaining your eye health

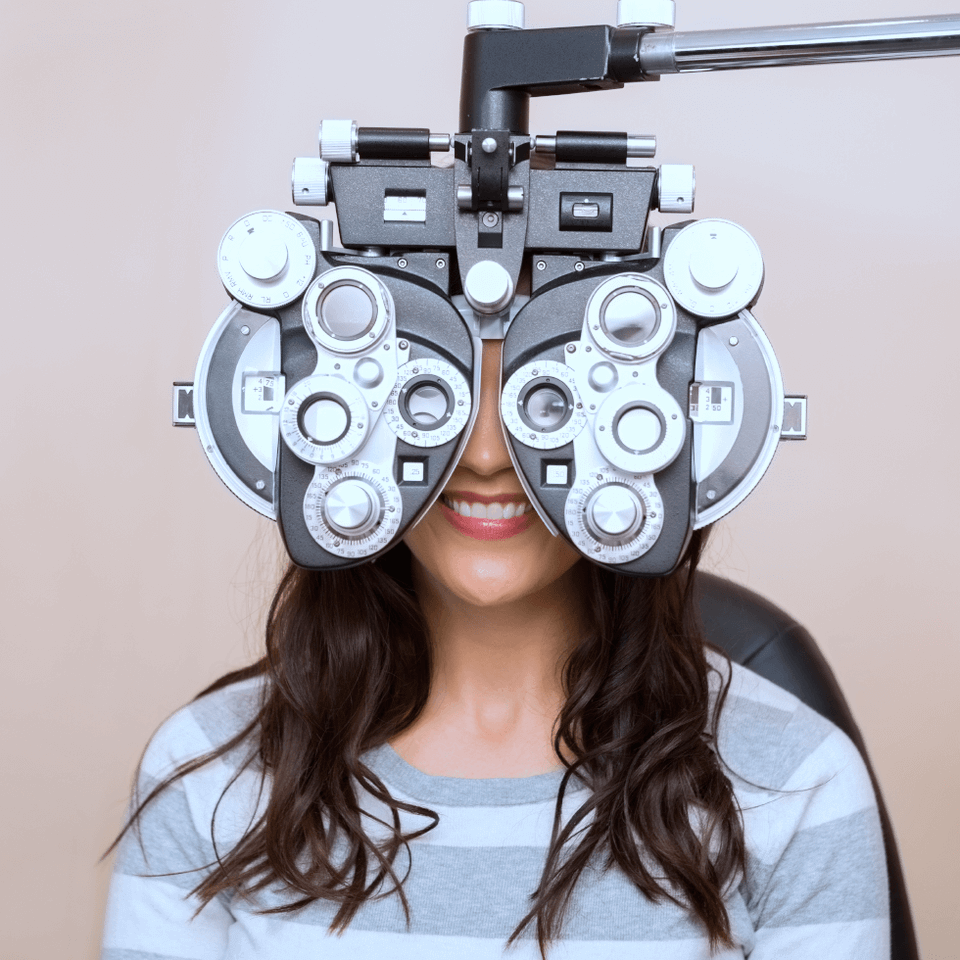

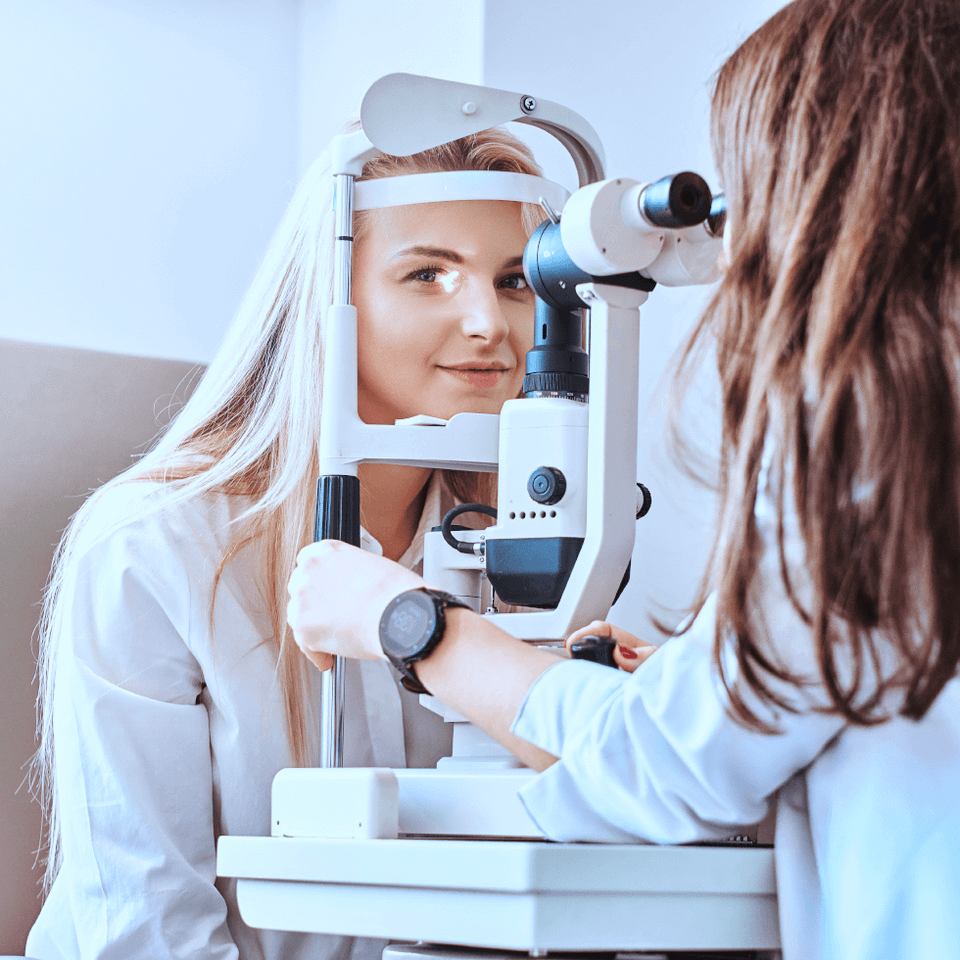

Many vision problems are subtle, and you don't notice detrimental changes over time. Your eyesight changes over time and your perfect vision from childhood may not hold up over the years. The best way to take control of your vision health is to conduct an annual comprehensive eye exam.

Poor eye health can also be a sign of serious medical conditions like glaucoma, diabetes, high blood pressure, or even cancer. It is important to conduct annual vision exams as preventive care, so you can detect vision problems early and avoid lasting damage to your sight.